Welcome back to another informative tutorial on Tally Prime or Tally ERP 9! In this tutorial, we will explore the world of groups and how they can help you efficiently manage your ledger accounts. Groups are an essential component of Tally, serving as the building blocks for organizing your financial data. Let’s dive in and discover the power of groups.

Understanding the Basics

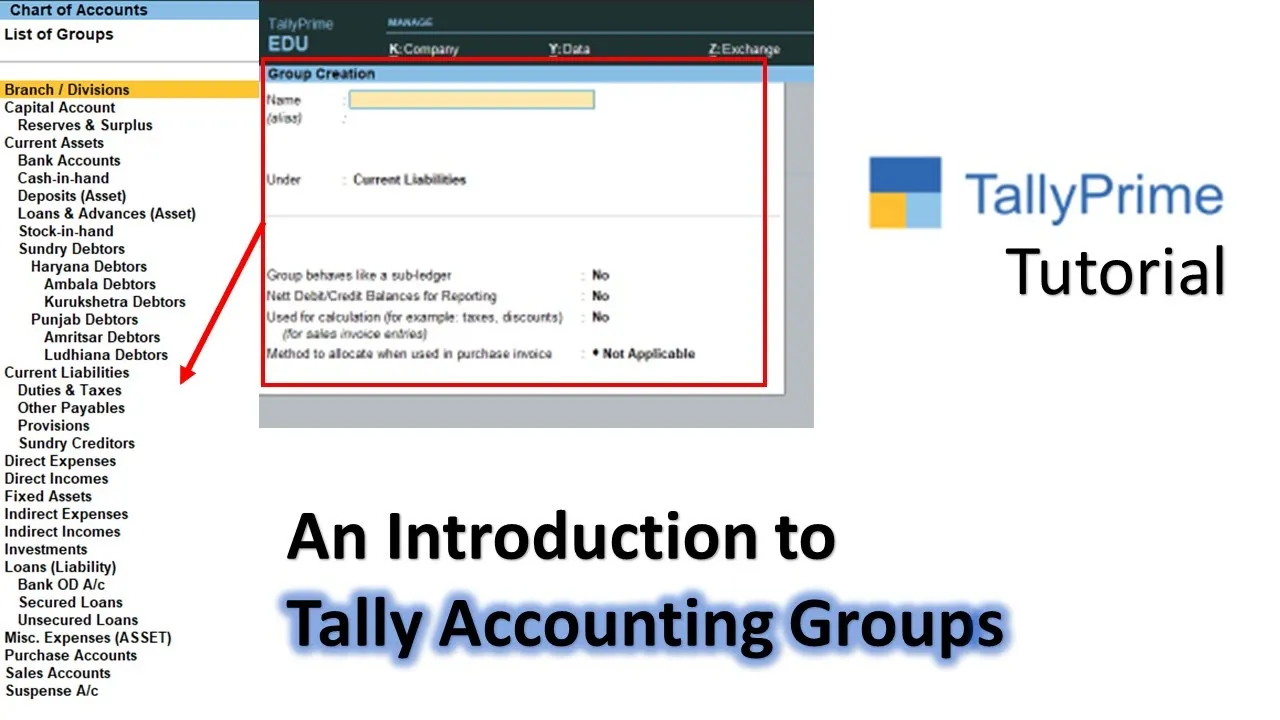

Groups in Tally can be found under the “Masters” section within the “Gateway of Tally.” There are two primary types of groups in Tally: stock groups and accounting groups. In this tutorial, we will focus exclusively on accounting groups, saving stock grouping for a future tutorial.

In Tally, groups serve as a hierarchical structure for categorizing your ledger accounts. These groups can be divided into two main categories: primary groups and subgroups. Primary groups are at the top of the hierarchy and are further divided into subgroups. The primary groups represent the main financial categories, while subgroups help you drill down into more specific classifications.

For example, consider the “Current Asset” group, which contains subgroups like “Bank Accounts,” “Cash in Hand,” and more. This hierarchical structure helps you organize your ledger accounts efficiently.

Creating New Groups

Now, let’s create some new groups to demonstrate how they can streamline your ledger management. Suppose you want to categorize your Sundry Debtors according to their location, such as states and cities. Here’s how you can do it:

- Go to “Create” in the “Masters” section and select “Groups” under “Accounting Masters.”

- Create a new group called “Punjab Debtors” under the “Sundry Debtors” group. This represents a state-level categorization.

- Next, create subgroups under “Punjab Debtors” for cities like “Ludhiana Debtors,” “Amritsar Debtors,” and “Haryana Debtors.”

- Further, create subgroups under city-level groups for specific areas or customers, like “Ambala Debtors” and “Kurukshetra Debtors.”

Modifying Ledger Accounts

With the new groups in place, it’s time to reorganize your ledger accounts. Consider your existing Sundry Creditors accounts and move them to the appropriate subgroups.

- Navigate to the “Chart of Accounts” and select “Ledgers.”

- Locate your Sundry Creditors ledger accounts that correspond to your state and city categories.

- Alter each ledger account by moving it to the newly created subgroups. For example, “Agarwal Shoe Material Store Ludhiana” should be moved to “Ludhiana Debtors.”

- Repeat this process for all relevant ledger accounts.

Benefits of Grouping

The advantages of using groups become evident when generating financial reports. For instance, when you access the “Trial Balance” and drill down into the “Sundry Debtors” group, you will find your ledger accounts categorized by state, and further by city. This structured view makes it easier to manage and review your accounts.

You can also filter your reports by using this grouping method. Instead of sifting through a long list of ledger accounts, you can now quickly access and analyze data based on specific categories.

Additional Examples

As a bonus, let’s consider another scenario. Suppose you want to create a new ledger account, “Telephone Expenses Payable,” but categorize it differently.

- Instead of modifying default groups like “Current Liabilities,” create a new group named “Other Payables” under “Current Liabilities.”

- Place the ledger account “Telephone Expenses Payable” under the “Other Payables” group.

- Add an opening balance for the ledger account.

- You can follow a similar process for other accounts, such as “Electricity Expenses Payable” and “Salary Payable.”

Conclusion

Using groups in Tally Prime or Tally ERP 9 can significantly enhance your ledger management and reporting capabilities. The ability to create custom groups and subgroups empowers you to organize your financial data according to your business needs, making it easier to track, analyze, and report on your accounts. This structured approach ensures accuracy and professionalism in your financial records.

We hope you found this tutorial helpful. Don’t forget to like, share, and leave your comments or questions below. For more insightful tutorials, subscribe to our channel.

Thank you for watching, and take care!